Posthaate: Canada’s expenditure review yields less than half of the necessary savings: CD Howe Report

Ottawa’s “extensive spending review” only yields about half of the savings that are necessary to put the federal finances back on track, according to a

Report from the Canadian think tank CD Howe Institute.

John Lester In his studies, Federal Expenditures Review: Welcome, but inadequate, estimates that the expenditure review launched in July will only cover a third of the federal program spending.

By Finance Minister François-Philippe Champagne strived for a 15 percent reduction in the operational issues of the government by 2028/29, with their answers at the end of this month. But Lester estimates that with the exceptions and cutting products potential savings are only $ 22 billion, less than half of the $ 50 billion needed to place the federal finances on a ‘careful path’.

“The ‘comprehensive expenditure review’ of the federal government is short of its name and goal,” he said.

Although the assessment focuses on operational expenses, Lester said that there are “substantial” carve outs. Some are for government priorities such as programs that support capital investments and the proposed increase in defense expenditure. Lester said that it also seems that transfers that are authorized by legislation and repayable tax credits will be exempt.

Most departments have an objective of 15 percent for cutbacks, but the target is two percent for the Department of National Defense, the Canadian Border Services Agency and the RCMP.

“With all these carve-outs, expenditure in 2025/26 will be subject to the” extensive “assessment $ 175 billion, which is about two-thirds of the operational expenses, but only a third of the program spending,” he said.

The amount of savings that he estimates that the assessment will generate is not sufficient to prevent an increase in debt-gdpp ratio compared to the forecast horizon.

Lester said that the scope should be widened with not only all programs, but also programs that have been delivered through the tax system.

The government must also leave the over-the-sign approach and focus on the poorest artists.

“It takes time to identify behind programs and to build up political support for substantial expenditure reductions,” said the report.

What Lester recommends is expanding the assessment, but the imposition of a multi -year limit for operating costs to deliver immediate restraint. Then the government can take more time to identify underperforming programs and build consensus to change them.

Register here To have PostHate delivered directly to your inbox.

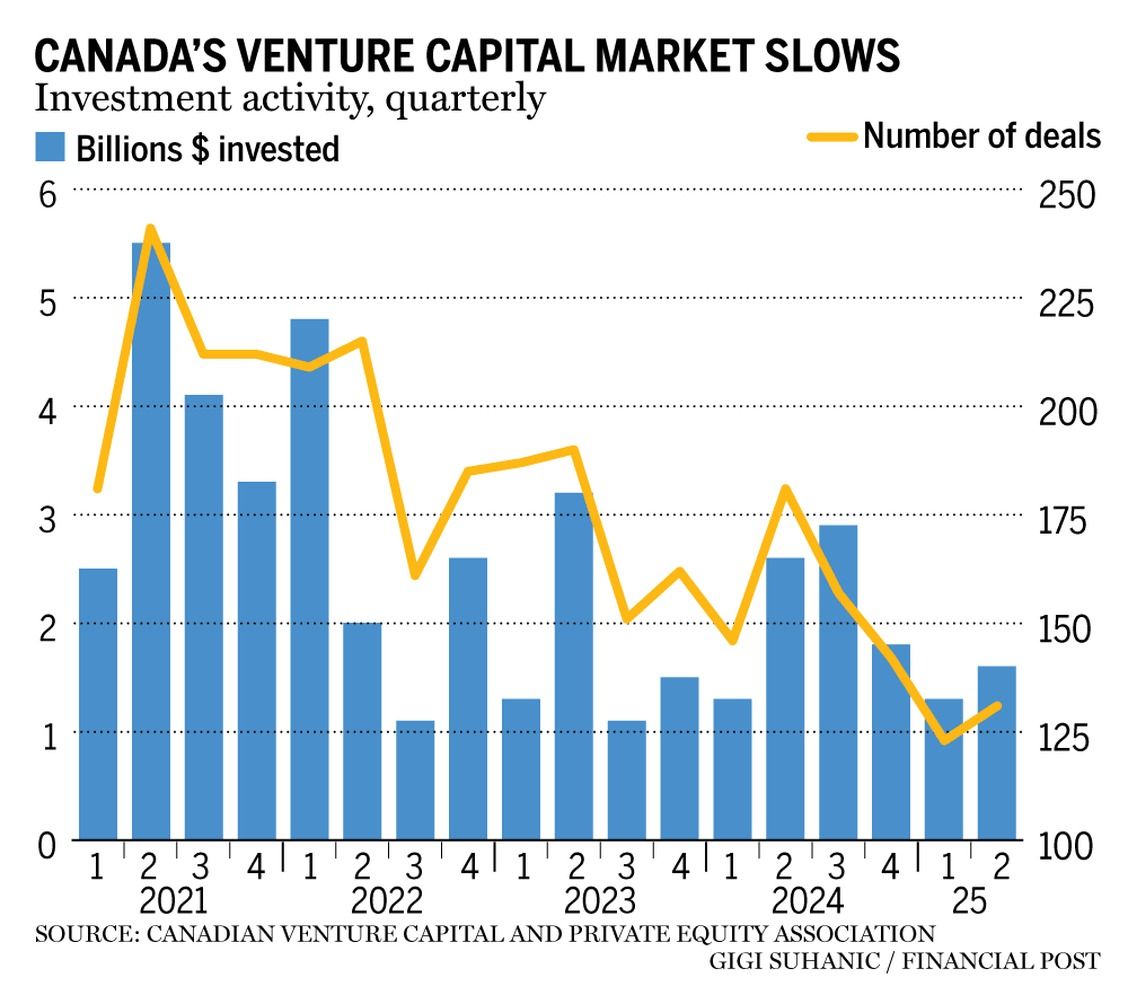

Evcant capital agreements in Canada have been delayed to a pace that was last seen at the height of the Pandemie, a new report from Canadian DurfTure Capital and Private Equity Association (CVCA).

Investors have put $ 2.9 billion in 254 Canadian VC deals in the first six months of 2025, a decrease in the number of dollars invested and 22 percent decrease in the number of deals.

It comes down to the lowest first half in total since 2020.

American investors are major players in Canada’s venture capital, but so far their participation has fallen by 3 percent this year compared to last year and reached by 8 percent decrease in a record high in 2021.

CVCA director David Kornacki said that global trade tensions and a similar delay in the US are behind the malaise.

Read more from Yvonne Lau

- Today’s data: United States Producer Price Index

- Income: Deere & Co.

- This is why you have to negotiate your rent, but you may need to go for a deal

- This 24-year-old technical employee sells vests and clocks through her side, and rakes an extra $ 1,000 every month

- Divorce has wiped out its savings. Does Kate have to start drawing CPP at the age of 65?

At the age of 65, Kate rebuilt her life and finance in a new province after having wiped out her savings. She would like to buy a house, but wonders if that is out of reach. Family Finance has some suggestions to make that happen, including signing Canada Pension Plan now instead of waiting. Read more

McLister on mortgages

Do you want to learn more about mortgages? The financial postal column of the mortgage strategist Robert McLister can help navigate by the complex sector, from the latest trends to financing options that you do not want to miss. Check its mortgage interest page on the lowest national mortgage interest in Canada, updated daily.

Financial message on YouTube

Visit the financial posts

For interviews with Canada’s leading experts in business, economy, housing, the energy sector and more.

Today’s posthaste is written by Pamela Heaven With additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Do you have a story idea, pitch, embargo report or a suggestion for this newsletter? E -mail us on

.

Make a bookmark of our website and support our journalism: Don’t miss the business news that you need to know – Add Financialpost.com to your bookmarks and sign up for our newsletters here