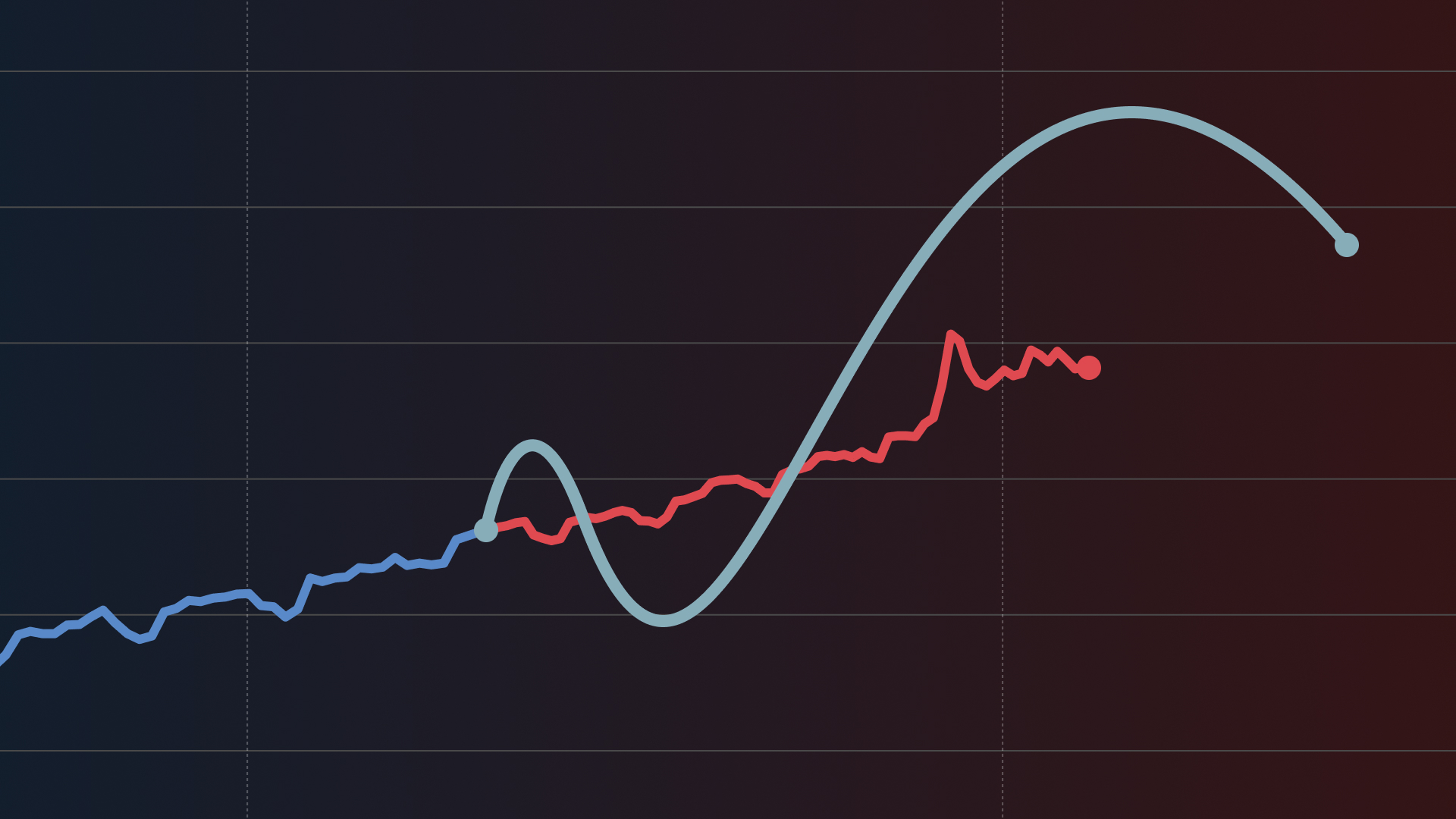

Draw it! Compare housing prices under the Liberals and Conservatives

Canada’s Housing Market: A Decade of Unhinged Growth

Canada’s housing market has been a hot topic for the past decade, with affordability reaching crisis levels before 2015 and only worsening since then. The combination of extremely low interest rates and high population growth has played a significant role in fueling this housing market frenzy.

Following the financial crisis of 2008, borrowing costs plummeted to emergency lows and remained at rock-bottom levels until inflation finally began to rise in 2022. This created the perfect storm for a housing market that was already teetering on the edge of a bubble. The low interest rates acted as rocket fuel, propelling housing prices to new heights.

The onset of the COVID-19 pandemic saw the federal government make a bold move by increasing the number of new immigrants allowed into Canada. This influx of new residents added to the already soaring demand for housing, further driving up prices. At the same time, the construction industry faced challenges such as rising costs and issues surrounding zoning, permitting, and development fees.

The convergence of these factors has resulted in a nationwide housing crisis with no clear solution in sight. The lack of a viable plan to bring housing prices down has left many Canadians struggling to find affordable housing.

As we look towards the future, it is clear that Canada’s housing market will continue to be a topic of concern. With no immediate solution in sight, it is crucial for policymakers to address the underlying issues contributing to the unaffordability of housing in the country. Only through thoughtful and strategic planning can we hope to create a more sustainable and accessible housing market for all Canadians.