Final report on Nova Scotia Loyal program reveals current model was untested

While some cheer for the opportunity to earn more Scene points and Air Miles, others remain confused about the Nova Scotia Loyal program.

Announced on Tuesday, July 23 at the Fundy Trail Sobeys in Truro, the Nova Scotia Loyal program seeks to supply national grocery chain Sobeys and the provincial liquor corporation with the means to promote local goods using an “enhanced procurement policy, branding to showcase local products and incentives for Nova Scotians to buy local.”

The incentive? For one week a month, Sobeys customers can collect extra Scene points when they purchase local products. NSLC customers will receive bonus Air Miles when they buy eligible alcohol products during “specified promotional periods” beginning on Sept. 30.

For some, this program is a far cry from Premier Tim Houston’s 2021 campaign promise, when he sought to have customers be able to buy local goods and collect points that could then be used to pay for provincial services, such as licence renewals.

Although any big box or independent store can pick up the Nova Scotia Loyal branding, and the economic development minister hopes to later include other grocery titans like Walmart and Loblaws, the points program is currently exclusive to Sobeys and NSLC and their respective loyalty programs.

This has left some to wonder who this program is loyal to—the national grocery chain currently under investigation for limiting retail grocery competition, or local producers and their valued customers.

A report obtained by The Coast, coming from an access to information request from the NSNDP, gives some insight into why the program took the turn that it did. The caveat is that the research for the program that is now in place is either unavailable or wasn’t done at all.

Although the report was supposed to be available online at openinformation.novascotia.ca last year, there is no record of it in their database as of publication.

Digging into the data

The report details three key areas of study: consumer behaviour insights, feasibility insights, and the program model framework. Unfortunately, much of this information, particularly on the latter topics, has been completely struck from the document under the reason that it contains “advice, recommendations or draft regulations developed by or for a public body or minister.”

Details regarding the prototyping work are provided, however. There were 24 prototyping sessions in total, ranging from farmers’ markets and independent grocers to a single chain of big box stores. 823 people participated in the prototyping with 238 completed surveys.

Province of Nova Scotia

Participant information on the prototyping study conducted in 2022. Several different types of grocer were analyzed, from big box stores like Sobeys to local farmers’ markets.

These prototyping sessions would feature local products with some incentive behind them to drive sales.

Monetary incentives included Tim Hortons cards for grocery stores and Market Bucks for farmers’ markets with an increasing reward for money spent and a baseline of $5 to $20 to receive the reward.

Gifts included chocolate, soap bars, cards, and candles for increasing amounts spent by consumers, starting at a minimum of $5.

The last incentive was a contest entry which the document refers to as “chance”, where consumers could enter for free to win a $500 Visa gift card. Entry did not require a purchase, though consumers could get additional entries for every $5 spent on Nova Scotia Loyal products.

The participating stores included Masstown Market, Port City Grocery, Jamieson’s General Store, Sobeys Bedford, Sobeys New Glasgow, the Lunenburg Farmers’ Market, and the Halifax Brewery Farmers’ Market.

These stores represent different demographics, according to the report. Masstown Market, for example, is characterized as a large independent rural grocer, while Jamieson’s is identified as a small independent rural grocer. The same goes for the two Sobeys that were analyzed—the one in New Glasgow is called a “large rural box store,” while the one in Bedford is called a “large urban box store.” The two farmers’ markets represent their general locations: HRM and the South Shore.

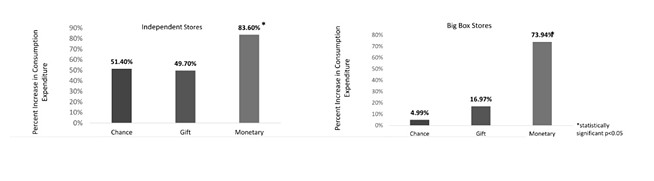

The first insight emerging from the report’s data was that offering a monetary incentive led to a “significant shift” in consumer behaviour at big box and independent stores. Local product expenditure for a monetary incentive was at 75.94 per cent, compared to the other two incentive types—chance and gifts—-at 14.57 per cent and 11.37 per cent respectively.

Chance and gift incentives showed a significantly greater shift in buying local in independent grocers than in big box stores, with each hovering around 50 per cent. For big box stores, the percentages were 4.99 and 16.97 respectively.

Province of Nova Scotia

While chance and gift incentives were more popular in independent stores, both independent and big box grocers saw monetary incentives succeed in encouraging participants to buy local.

Limitations

Farmers’ markets are a different story. Most customers—64 per cent—shopped as normal, and said the opportunity for rewards did not increase their purchasing of local products, and that there was no statistically significant difference between prototyping days and regular days. The report indicates that a “different approach” may need to be taken with farmers’ markets to “meet the NSL program objectives.”

However, the data on farmers’ markets is rather limited, as indicated by the report. Direct sales data was unable to be collected due to several factors, including vendor confidentiality, so instead vendors were surveyed on the perception of their sales.

The data in general has a couple of hurdles associated with it. For instance, participants in the prototyping program were typically:

- Employed or retired (67 per cent and 21 per cent respectively);

- Educated at a post-secondary institution (89 per cent);

- Had an average household income of $92,000.

These are all far above the provincial averages. The average annual income was $71,000, the actual employment rate for working Nova Scotians was 57 per cent, and the average rate of people with a post-secondary education was 64 per cent.

Several other limitations are listed in the report, such as low sample sizes, prototyped products being unavailable at certain stores, changes in monetary incentive—between Tim Hortons cards and Market Bucks—as well as selection and exclusion bias in terms of those who participated in the study and the products prototyped.

Existing loyalty programs

Listing some key insights from this data, the report suggests maximizing the number of eligible products to increase program participation, giving future data sets a better sample size and perhaps a more varied array of people to be surveyed, as well as utilizing different approaches for different retailers.

Also included in those insights is the potential impetus for the program we have today. The report considers ”leveraging existing loyalty programs” to help with program uptake.

The report does go into detail about the participation of loyalty programs. Consumers were asked whether or not they were members of PC Optimum, Air Miles, Aeroplan, or none of the above. The survey found 75 per cent collected Optimum points, 64 per cent Air Miles, and 33 per cent Aeroplan. Ten per cent of respondents participated in none of these programs.

This is, however, the only mention of already existing loyalty programs available in the report, and no other studies seem to be available on the feasibility of loyalty programs as an approach to the Nova Scotia Loyal program.

Rather, it seems like they stripped everything else away and went in a completely different direction—away from monetary, gift, and chance-related incentives at multiple stores on multiple levels, and towards using an existing loyalty program associated with one of Canada’s biggest grocery chains.