GOP governor rallies around historic proposal to slash state’s income tax

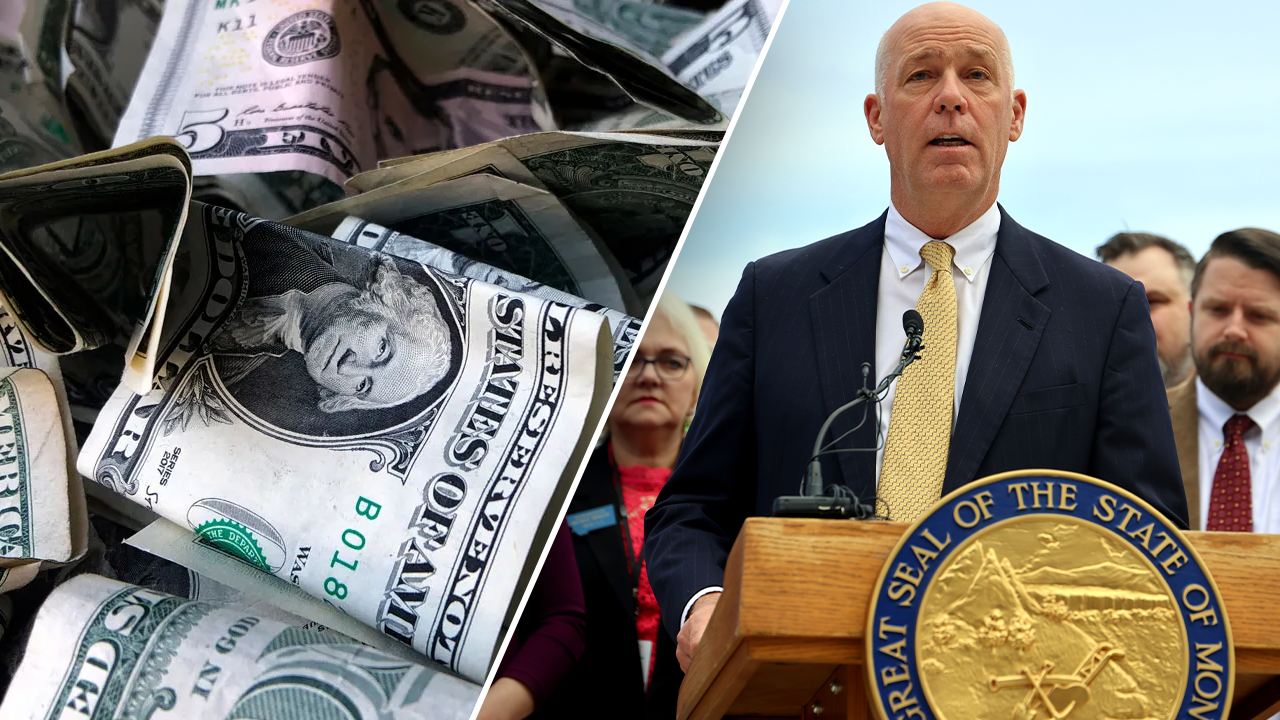

Montana is considering making significant cuts to its individual income tax rate, following a growing trend among states that have completely eliminated the tax altogether. Republican Governor Greg Gianforte recently voiced his support for Senate Bill 323, which aims to reduce the state income tax from 5.9% to 4.9%. In a news conference with Americans for Prosperity, Governor Gianforte highlighted the importance of allowing citizens to keep more of their hard-earned money, stating that Montanans know how to spend their money better than the government.

Upon taking office, Governor Gianforte inherited the highest income tax rate in the Rocky Mountain West, prompting him to prioritize tax reform and simplification of the tax code. Over the years, Montana has made strides in lowering its tax rates, with the most recent adjustment bringing the rate down from 6.75% to 5.9%. The state has also streamlined its tax brackets from seven to two, with the proposed cut in Senate Bill 323 inching closer to a flat tax system.

If passed into law, the bill would further reduce Montana’s tax rate to 5.4% in 2026, ultimately reaching 4.9% in 2027. This move would provide much-needed relief to residents like Bianca Lester of Butte, a single mother of four who emphasized the importance of retaining their hard-earned income. The proposed tax cuts have garnered support from prominent figures such as Donald Trump Jr., who praised Governor Gianforte for championing conservative tax policies akin to his father’s historic tax reforms.

The push for tax cuts in Montana coincides with similar efforts in other states, such as Mississippi, where Governor Tate Reeves recently signed legislation to phase out the state’s income tax entirely. The move is seen as a strategy to stimulate economic development and attract businesses to the region. In addition to individual income tax reforms, Montana is also addressing property tax issues through legislative measures.

On a national level, President Donald Trump and congressional Republicans are advocating for comprehensive tax reforms, including proposals to eliminate taxes on tips and overtime pay. Governor Gianforte remains optimistic about the prospect of passing the tax cut bill, emphasizing that Montanans deserve to have more control over their finances. As discussions on tax reform continue to unfold, the focus remains on empowering individuals and fostering economic growth across the state.

In conclusion, Montana’s consideration of reducing its individual income tax rate reflects a broader trend towards tax relief and simplification. With Governor Gianforte’s leadership and support from various stakeholders, the state is poised to make significant strides in creating a more favorable tax environment for its residents. As the debate on tax reform evolves, the ultimate goal is to promote financial freedom and prosperity for all Montanans.