Is that $5 coffee actually free? How TikTok’s ‘girl math’ trend is changing the online money conversation

Is your morning coffee free of charge because you bought it with a pre-paid card?

Are you losing money if you walk past a retail sale without buying something?

Is that item free because you paid for it with cash?

If you answered yes to any of the above questions, you may be familiar with the concept of “girl math,” a recent TikTok trend that where people explain their personal rationales for spending decisions that may not make traditional financial (or mathematical) sense. Investment advisors and personal finance experts say as long as the explanations are treated as just for fun, girl math can actually encourage financial transparency and open up discussions about money.

“Basically, girl math is mentally counting,” explained Alyssa Davies, the founder of financial blog Mixed Up Money and a TikTok creator based in Chestermere, Alta.

“It’s not just women that do this,” she said. “We all do this sort of rationalizing when it comes to our expenses.”

But the girl math trend can take rationalizing spending to a new level.

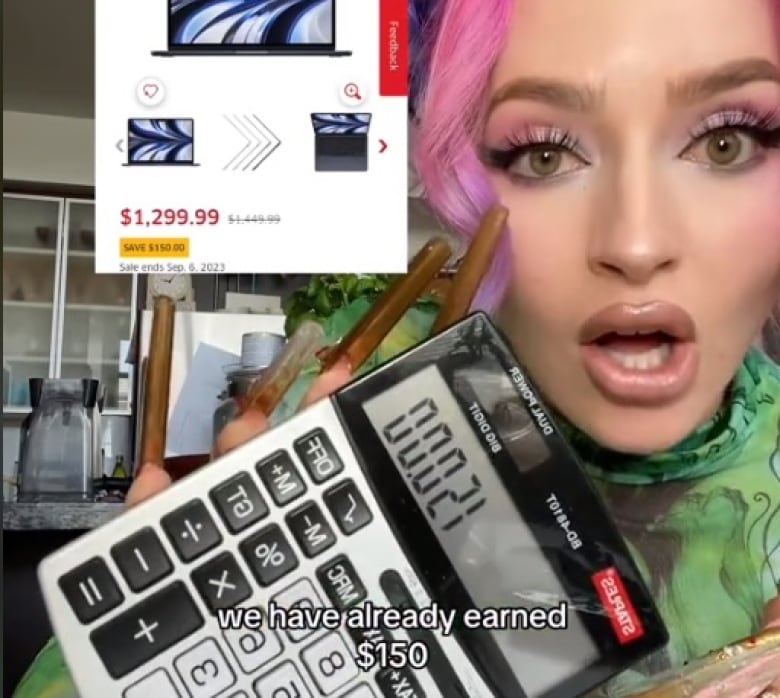

“We have already earned $150,” says TikTok creator vialsss after finding a MacBook, regularly priced at $1,450, on sale for $1,300 in a video with the hashtag #girlmath.

The girl math rationale here is that by finding the item on sale, the $150 price difference is earned money.

A fun trend not to be taken too seriously

“Return something at Zara for $50, bought something else that was $100, it only cost me $50. Girl math,” explained TikTok user samjamessssss in a video that’s been liked more than 628,000 times.

The original $50, normally accounted for in a budget, doesn’t count in this case because it was already spent.

The World this Weekend19:45How the ‘Girl Math’ trend is taking over TikTok | Capsule Edition

On this episode, many people are turning to the social media app TikTok for financial advice – we look at whether the benefits outweigh the costs. Also, skilled workers from Nigeria are looking for opportunities to work in Canada — which could create a shortage in the country’s workforce. Plus, we take you to Modena, Italy – where producers of Parmesan cheese are using technology to fight knockoffs.

Davies says these kinds of mental gymnastics are all in fun and are really about how people decide whether purchases are worth it.

“Overall, I do think it’s something that’s just to be taken lightly and not too seriously,” she told CBC News.

According to Davies, part of the appeal of girl math is that it makes it easier to talk about money and purchases in general, despite the stigma many feel around discussing finances in public.

“When a trend like this appears where we can share these sort of interests that we all didn’t realize other people might have, we feel so much less alone,” she said.

Traditional advisors urge caution

More traditional financial advisors, such as Jordan Dawes, have embraced some money talk trends on TikTok, but say Canadians should be careful when taking monetary or banking advice from social media platforms.

“I would hope that it’s used for humour and not taken literally,” said Dawes, who is based outside of Victoria. “But I’ve been around enough financial institutions to know that people can take those things seriously.”

A TikTok creator himself, Dawes says he tends to offer more traditional financial advice, but notes that as long as Canadians who engage in “girl math” are following some key principles, they’ll be fine.

“Do whatever you need that makes you happy. Live in the moment,” he said. “Just make sure a small amount is going towards long term savings.”

Sam Lichtman, a financial advisor based in London, Ont., echoes that advice and offers additional caution for Canadians who may base their entire budgets on how online creators handle their finances.

“It gets to cross the line when people start talking about where they invest their money, how you should invest your money and what amounts they’re putting on debt, and if you should be doing the same thing,” said Lichtman.

Is ‘girl math’ sexist?

The term girl math has been called “infantilizing,” according to Davies, who told CBC News she understands that criticism, but feels there’s no harm in the phrase.

She calls it “gen Z slang” and says the trend is worthwhile because it helps puts women at the centre of financial conversations that might not happen otherwise.

This is a trend created by women for women. And that’s what makes it feel a little bit less icky for me.Alyssa Davies, founder of Mixed Up Money

Though she acknowledges that negative stereotypes exist around women and money, Davies doubts the girl math trend is responsible for them.

“This is a trend created by women for women. And that’s what makes it feel a little bit less icky for me.”

In the end, she said, sound financial principles remain the same, even if the math is gendered.

“You have to know how much money is coming in every single month and how much money is going out,” said Davies.

“If you’re aware of that and you’re spending money and you’re doing the girl math, it’s OK.”

;Resize=620)

;Resize=620)

;Resize=620)

;Resize=620)