Nova Scotia deficit improves, thanks to higher tax revenues

Nova Scotia’s budget deficit is now forecast to be $264.3 million for 2023-24, which marks a small improvement over previously anticipated estimates, despite a significant increase in revenues of more than $492 million.

The province released its December budget update Monday, which showed this year’s projected deficit is forecast to be $138.4 million less than the more-than-$402.7-million deficit projected in the last budget update in September.

The new December figures also reflect a $14.6-million improvement from the original $278.9-million deficit forecast in the Progressive Conservative government’s annual provincial budget released last March.

But while the spending shortfall is slightly rosier than expected, it comes as the province is experiencing record population growth and, in turn, higher revenues from personal income taxes.

Total revenue for the province is projected to be $14.8 billion, up $492.7 million from the March budget estimate. More than $355 million of this amount is from increases in provincial income tax revenues.

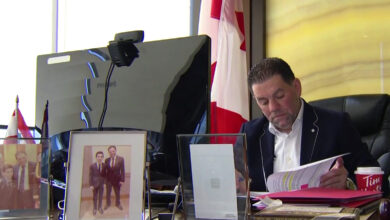

But Finance Minister Allan MacMaster warned Monday that while the province’s economy has benefited from significant growth in revenue, it is not anticipated this rate of growth will continue.

“While the economy performed well in many areas, we do see it softening in 2023 and a return to normal economic trends after a volatile period,” MacMaster told reporters in Halifax on Monday.

“Our economy will continue to grow, but at a slower pace than that which we saw coming out of the pandemic.”

Population boom

Part of the increased tax revenue can be explained by a population boom. Nova Scotia’s population surpassed one million in July, last year increasing by 3.24 per cent over the previous year and is projected to grow another 2.6 per cent this year – a rate of growth the province says is “faster than in any other period on modern record.”

Personal income tax revenues are also higher than expected due to significant wage growth in the province. Average weekly wages have gone up by 6.7 per cent, driven by strong growth in a number of sectors, including agriculture at 20.8 per cent; forestry, fishing and mining at 19.4 per cent, manufacturing at 18.8 per cent and accommodation and food services at 17.2 per cent.

But while the population boom has helped line provincial coffers, it has also led to increased expenses in housing and health care, MacMaster said.

Figures released Monday show the PC government will spend a total of $15.3 billion in 2023-24, which is $440 million over what it planned to spend in its March budget.

The majority of this increased spending – $363.4 million – is going toward wage settlement and contract agreements with doctors, nurses and other health care workers negotiated over the last several months.

Of this, $135 million in additional spending will be spent on “travel nurses” in health centres and long-term care facilities.

Assistance programs

Other major expenditures that exceed projected spending amounts or that were not reflected in previous budget forecasts include $82.6 million by Service Nova Scotia, most of which will go toward the heating assistance rebate program, with the rest going to trail repairs needed following the July 2023 floods.

Disaster assistance funding to address damage from the summer wildfires and floods account for close to $59 million in additional spending in the Municipal Affairs and Housing budget, although about 70 per cent of this funding will be recovered from the federal government.

Community Services is also spending $41.8 million, or 3.2 per cent, more than it planned to spend on initiatives to provide employment support and income assistance to Nova Scotians and to address homelessness.

Also, Public Works is spending $33.2 million, or 4.9 per cent, more than expected, mainly due to July 2023 storm damage with some of this spending going toward the Halifax infirmary expansion project.

Meanwhile, the province will spend $53.7 million less than anticipated on capital projects due to an ongoing shortage of workers and disruptions in supply chains.

Higher consumer spending

The provincial numbers also highlight a number of key trends.

For example, a drop of $8.3 million, six per cent, in expected revenues from tobacco taxes show fewer Nova Scotians are smoking.

An increase in anticipated revenues from the harmonized sales tax (HST) of $63.9 million, or 2.6 per cent, shows higher consumer spending.

And, despite concerns over increased costs due to the federal carbon pricing program, Nova Scotians are spending more on gasoline. Provincial figures show anticipated revenues from the motive fuel tax – which is based not on fluctuating gas prices but on the volume of gas sold – went up by 7.2 per cent this year to $19.8 million compared to what was expected in March.

MacMaster, whose government is among those pushing the federal government to repeal the carbon tax, took the opportunity to highlight this Monday, saying the Nova Scotia data shows the Trudeau government’s plan to lower emissions through taxation is not working.

“We see the price of gasoline increased, yet on a per capita basis, so not due to population increases, but on a per capita basis, we see an actual increase in the purchase of gasoline,” he said.

“So, the carbon tax does not work.”

But NDP Leader Claudia Chender was critical of the updated budget numbers, saying they showcase millions in “unaccountable spending” while Nova Scotians continue to suffer with increased costs for housing, food and necessities.

“We hear from the Houston government nearly every week about some new spending but for everyday Nova Scotians, it’s not moving the needle,” she said in a news release.

“There are hundreds of people sleeping outside and the Houston government has left folks to struggle, cutting back on who was eligible for the heating assistance rebate, ignoring our calls to cut the tax on all groceries, and refusing to help renters or ban childcare waitlist fees.”