Oil industry continues focus on returning cash to investors over new big projects

While Alberta’s oilpatch continues to make billions of dollars in profits, much of that money is finding its way into shareholder’s pockets rather than toward major expansions of their operations.

At the time of the last boom, oil producers poured a large portion of their earnings back into capital spending. In 2014, for example, oil and gas investment in Canada ranged around $80 billion.

Today, it’s closer to $30 billion, according to the latest numbers from the ARC Energy Research Institute, which models the entire Western Canadian Sedimentary Basin.

It means that in recent years, a flood of cash hasn’t sparked a surge of new projects in the province. Suncor’s Fort Hills mine, the last major oilsands facility, opened in 2018.

“The real change in behaviour was really more around before 2020, where companies were putting a lot more of their cash flow into [capital expenditures] and growth,” said Jackie Forrest, executive director of ARC.

“After the 2020 period, it really shifted to today. Only about half of the cash flow is going toward [capital expenditures] and growth. The other half is going to shareholders.

“The governments are also a very significant stakeholder that is receiving almost as much as the shareholders. Of course, that benefits all Canadians through royalties and taxes.”

The graph above shows after-tax cash flow, which is the money oil companies have left after covering their costs, including to governments.

They use it to pay down debt, invest in projects, buy other assets, or give money back to shareholders through dividends and stock buybacks, said Richard Masson, an executive fellow at the University of Calgary’s School of Public Policy and the former CEO of the Alberta Petroleum Marketing Commission.

Masson noted companies are reinvesting about half of their after-tax cash flow, which is a higher ratio than during the early pandemic years.

But most of that money goes toward maintaining current production, not expanding it, he said.

“There’s only small amounts of that that are actually growth capital,” he said.

“It’s not bad,” he added, “but we haven’t been able to really grow the industry because we haven’t been assured of market access and good prices.”

What’s at play?

Charles St-Arnaud, chief economist at Alberta Central, the central banking facility for the province’s credit unions, said available data for non-Canadian oil producers show similar patterns.

“They’re also reinvesting less of their revenues into their operation,” he said.

St-Arnaud said there are many international factors at play here, one of them being forecasts such as from the International Energy Agency, which show oil demand plateauing somewhere in the 2030s and then gradually coming down.

“Does it make sense globally to invest massively in expanding oil production in this context?” he said.

Masson, meanwhile, said future investment depends on a number of factors.

“It depends entirely on the resource, and on market access, and on access to capital, and on skill of the workforce,” he said.

“Canada is one of the more competitive places in the world for investment, and we have a lot of running room left.

“Even in a world that sees peak oil in the mid-2030s, because even then, almost all the actual forecasts, which are different than scenarios, most forecasts see a very shallow decline out past 2050.”

At the same time, global investor expectations have shifted, Masson said.

“That grew out of the Permian [Basin] in Texas, where it was growing so rapidly, so much investment was happening, that shareholders kept adding more funds to the industry, but they weren’t getting any returns,” he said.

“Eventually, they got fed up with that and said, we need to see more cash coming back. And that trend spread from New York across Canada as well, where Canadian companies had to compete by returning cash to shareholders.”

Masson said industry leaders also continue to cite regulatory uncertainty, including when it comes to legislation like Bill C-69, also known as the Impact Assessment Act, and the proposed emissions cap, as barriers that are holding back new investment.

Steady, but not busy

In Fort McMurray, Alta., the heart of Alberta’s oilsands, the volatile nature of the province’s boom-and-bust oil industry has been witnessed first-hand over decades.

These days, it seems things are neither boom nor bust.

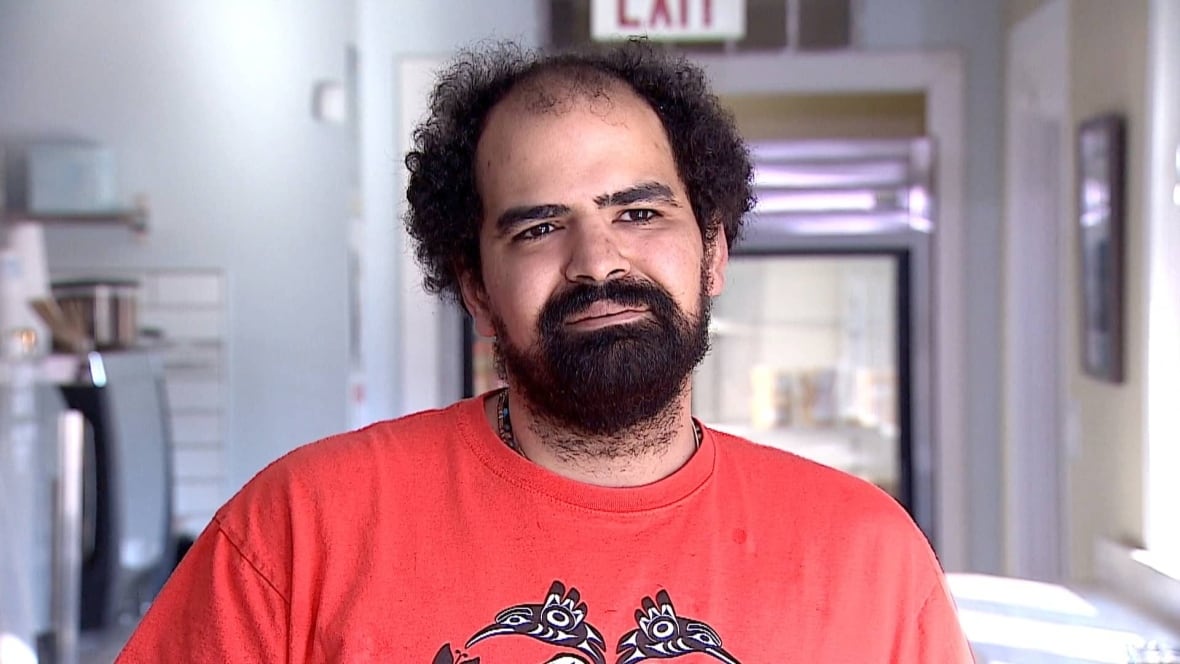

For Owen Erskine, owner of Mitchell’s Cafe in downtown Fort McMurray, the past few years have been steady, but not busy.

“I don’t think we’ve seen as much of a personnel boom as in years past … we’re seeing more oil at some points, but I think they’re kind of at a bit of a bottleneck where it comes to investment and that sort of thing,” Erskine said.

“We’re not seeing a crazy huge [rush of] out-of-town people coming into the city right now.”

Erskine, who has lived in Fort McMurray going on 36 years, said the community is well-acquainted with the nature of the industry.

“What we’re seeing now is, like, since the last couple of busts, we don’t have such an intense boom,” he said. “The busts have become a little bit less jaw-dropping, especially as a small business like we are.”

The ‘mature’ phase

Oil has been a boon for the province, but it also means that Alberta is heavily dependent on an income stream that will face challenges as the energy transition continues, according to St-Arnaud.

“[The government has] been very proactive at ensuring that those revenues are still there and protecting those revenues, because it’s a big source of funding for the government,” he said.

“If it’s not there, there will be a very tough choice. And a very hard conversation is, do we keep the level of services or increase tax?”

In St-Arnaud’s view, the industry may have reached a “mature phase” where companies are focused on optimizing existing operations rather than expanding production.

“As much as I was saying that the mid-2000s to the mid-2010s was the startup phase, well, we’re in a mature phase where we’re producing,” he said. “Those companies are making a very good return on those investments, and they don’t see the need to expand dramatically.”

Masson, meanwhile, said the recent Trans Mountain pipeline expansion has helped, but is already nearing full capacity. Building new infrastructure, especially pipelines to the West Coast, could take up to a decade, making long-term planning difficult.

“It’ll probably carry on in that range, $30 to $40 billion, for the future, until we know what we have for market access and we see some of the federal policies that the CEOs are talking about get changed,” he said.

The year ahead could also test how oil companies prioritize their money if prices drop, Forrest said.

“If we do get prices in the below $60 [US] or in the $60 [US] range, I think you’re going to start to understand what the priority is,” she said.

“And I think the shareholders are going to be a pretty big priority in terms of, if cash flow is more scarce, what they do with it.”