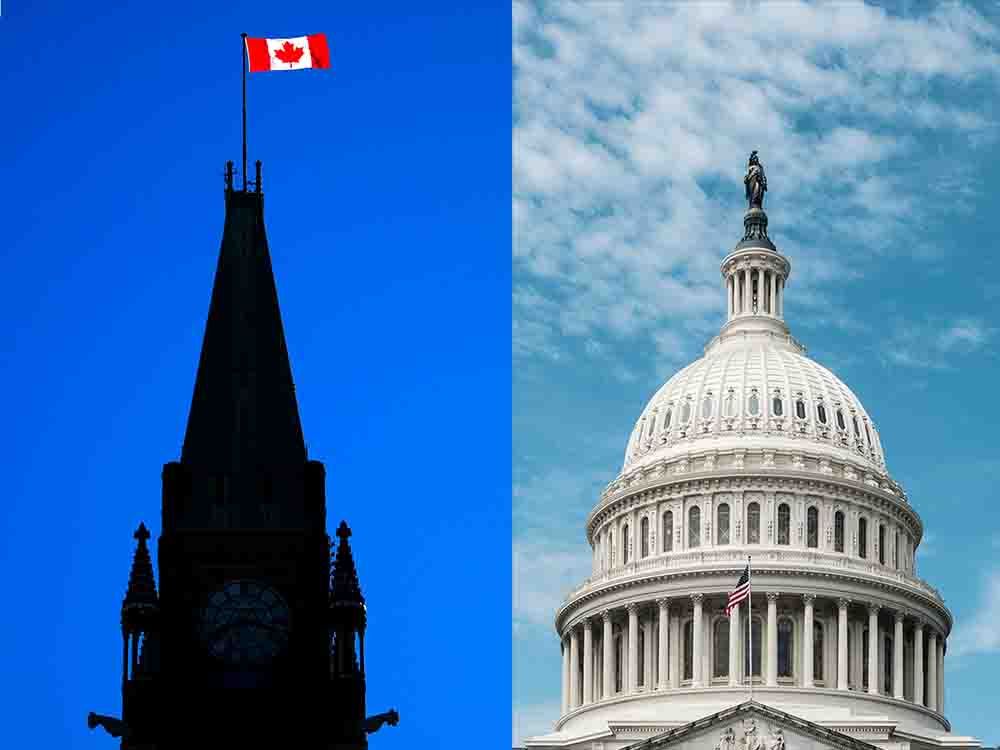

Posthaste: Who is the worst budget 'basket case' — Canada or the U.S.?

Canada and the United States are both tapping into debt markets at a rapid pace, according to economists at the National Bank of Canada. While the U.S. is often criticized for its fiscal deficit, Canada is also heavily borrowing to finance its government operations.

In a recent report, economists Warren Lovely and Taylor Schleich pointed out that Canadian governments, both federal and provincial, have been aggressively issuing debt in recent months. From April to August, these levels of government issued around $220 billion in gross bond supply, with Ottawa’s share increasing by 44 percent compared to the previous year.

Despite some differences in the nuances of borrowing between the two countries, the overall trend shows that Canada is borrowing at a similar pace to the U.S. In fact, the pace of debt issuance in Canada was even higher when compared to GDP.

Looking ahead, more borrowing is expected from the Canadian federal government, especially with the delayed federal budget set to be released in the fall. This borrowing spree is in line with the government’s plans for infrastructure projects and other investments.

While Canada has often been praised for its low national debt-to-GDP ratio, the economists caution against complacency. They emphasize the importance of financial transparency, budget credibility, and effective policy implementation to ensure sustainable economic growth.

Overall, both Canada and the U.S. are facing significant debt burdens, and it will be crucial for policymakers to make sound financial decisions to navigate the challenges ahead.