POSTHATE: The younger generations of Canada are worried that they cannot afford to found a family, says BMO

Buying a house is the biggest single -financial transaction that many Canadians will ever undertake in their lives, but having children comes a close second.

Eight out of 10 people said that their children brought them happiness and fulfillment, but 53 percent said that their bundles of joy also endanger their financial security, according to the last real financial progress index of Bank of Montreal, and that complaint has bled in younger generations.

Seven out of 10 gene and 69 percent of the millennials said they want to have children, but fear of starting a family will “influence their financial future”.

The negative feelings about the financial toll of parenting do not stop there.

For example, 84 percent of the respondents said that the costs of raising children had become ‘unmanageable’, whereby parents were the costs of groceries, toys and activities, daycare centers, housing, baby supplies, clothing and prams who had their finances.

In the meantime, 86 percent of parents said that the costs of daycare centers, after -school programs and school supplies “negatively influence their ability to save for long -term goals such as higher education or homeowner.”

More than three -quarters also admitted that they were busy as parents to keep up with other families by spending more than should.

“For many Canadians, starting and raising a family is one of the most meaningful journeys in life, but it can also bring significant financial and emotional pressure,”

Gayle Ramsay

Head of daily banking, segment and customer growth at BMO, said in a release.

The Bank of Canada said that there is a “growing pessimism among Canadians about their financial health” in its latest overview of the expectations of consumers that were released at the end of last month.

The parenting of a child certainly explains pressure on the finances of a family, with the amount that is spent on family income and, to a lesser extent, family size,

said in a report from 2023 about the costs of raising a family.

The agency estimated that a two -parent family with two children and a annual income of more than $ 135,790 from 2014 to 2017 spent an average of $ 403,910 per child from birth to 17 years. The family of the same size earned less than $ 83,013 that earned an average of 52 percent less or $ 238,190 per child.

The costs rose with nearly a third if adult descendants of 18 to 22 years old continue to live, said Statistics Canada.

Of course, these costs have only risen since the report was based on data from 2017.

Although parents could sometimes find the costs of raising children a heavy burden, BMO said that 22 percent of the respondents thought they should continue to support their children until they found a full -time job, while the same share said that their children deserved their financial support, regardless of the stage of life.

On average, Canadians believe that parents should support their children financially in a certain capacity for 19 years.

BMO launched his financial progress index in 2021 to measure how people feel about their personal finances. For this version of the index, Ipsos Canada investigated around 2500 Canadian adults between 10 June and 17 July.

Register here To have PostHate delivered directly to your inbox.

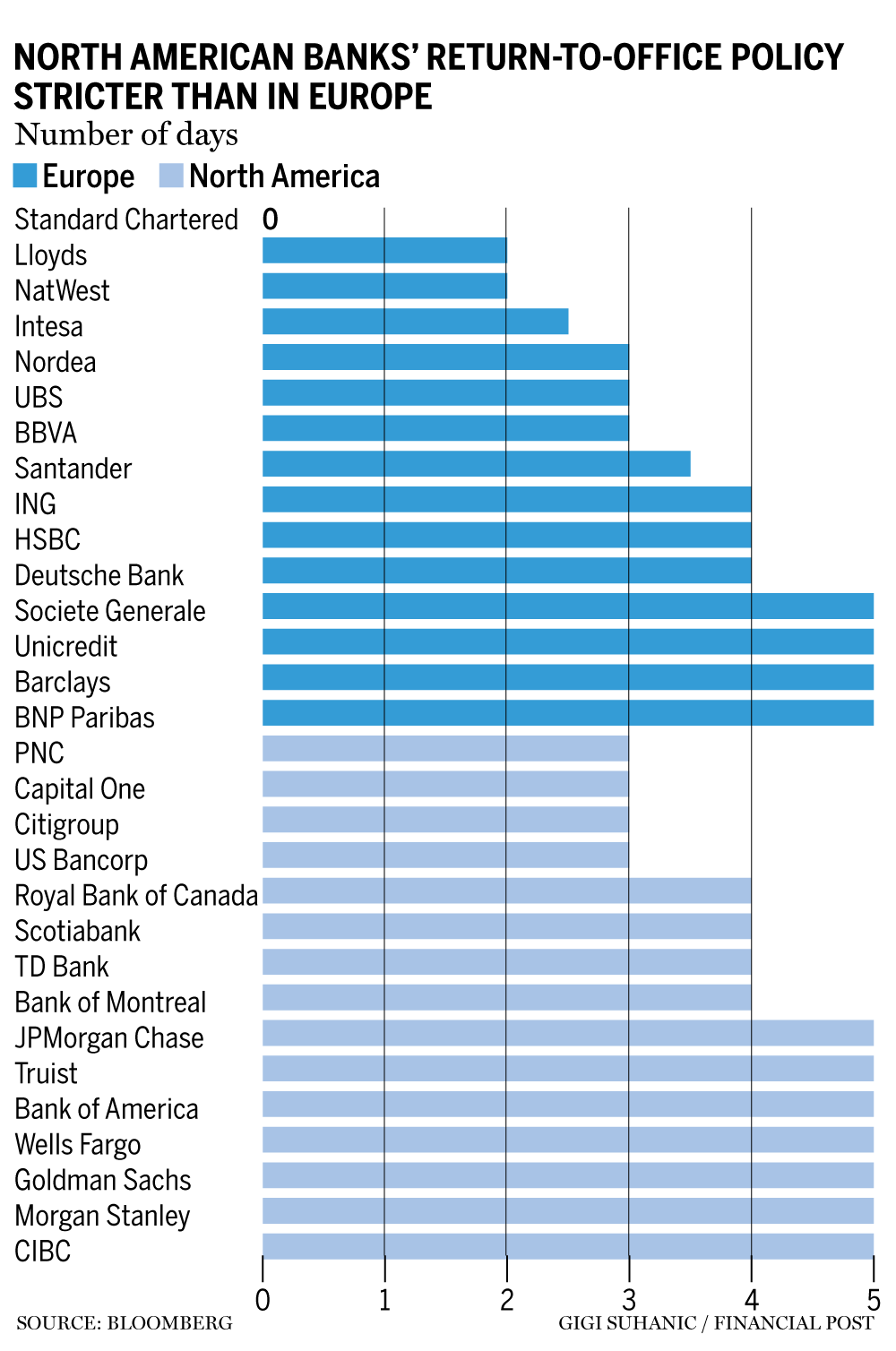

The American and Canadian banks call employees back to their offices faster than European rivals, so that the gap is widened in one of the determining debates of the financial workplace.

Five years after COVID-19 pushed most employees into temporary home work, only seven of the 15 most valuable banks in Europe asked some or all their employees to spend four or more days in the office per week, according to a Bloomberg analysis. That figure rises to 11 over a group of 15 of the most valuable banks in North America. – Bloomberg

Read the full story here.

- Minister of Natural Resources Tim Hodgson will make a financing announcement for clean electricity projects in Ontario in Markham, Ont.

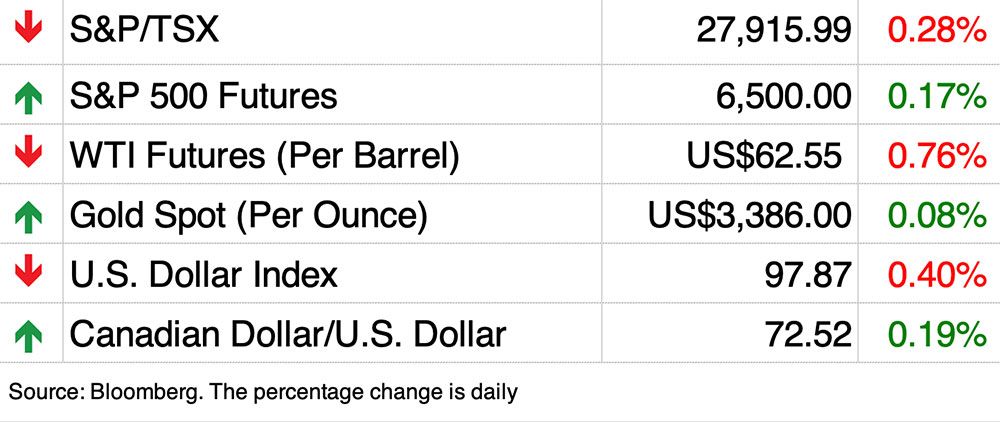

- Today’s data: Statistics Canada releases data on production and wholesale sales for June and existing home sales for July. The US provides retail sales for July, the import and export price indexes, capacity use and business stocks for July and the University of Michigan Consumer Sentiment Index for July.

- Income: Lithium Royalty Corp., Jones Soda Co., Flowers Foods Inc.

- Ontario calls officials back to the office full -time

- The American Eagle campaign from Sydney Sweeney was intended to sell jeans. Instead, it sold a lesson in employment law

- Blackstone’s purchase of Enverus a deployment that will send new era in energy, says CEO, says CEO

This moncton pair came under some financial pressure after a cancer disease has increased their financial life. They have asked FP answers to help them with a strategy they have devised to make cash in registered pension savings plans to maximize the protection of old age and guaranteed income supplements. The couple, both currently 62, said they can survive about those government benefits. Read more about what to do here.

Are you worried about enough to retire? Do you have to adjust your portfolio? Do you start or do you make a change and do you wonder how you can build up wealth? Are you trying to make ends meet? Let us fall on a line

With your contact details and the core of your problem and we will find some experts to help you when writing a family -financially story about it (of course we will keep your name out).

McLister on mortgages

Do you want to learn more about mortgages? The financial postal column of the mortgage strategist Robert McLister can help navigate by the complex sector, from the latest trends to financing options that you do not want to miss. Check its mortgage interest page on the lowest national mortgage interest in Canada, updated daily.

Financial message on YouTube

Visit the financial posts

For interviews with Canada’s leading experts in business, economy, housing, the energy sector and more.

Today’s posthaste is written by Gigi Suhanic With additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Do you have a story idea, pitch, embargo report or a suggestion for this newsletter? E -mail us on

.

Make a bookmark of our website and support our journalism: Don’t miss the business news that you need to know – Add Financialpost.com to your bookmarks and sign up for our newsletters here