Young Halifax renters may have to save for over a decade to buy their first home

A new study from Point2Homes suggests young renters in Halifax will have to save money for over a decade to purchase a starter home at the current average price.

The generational study uses data from Statistics Canada’s 2021 Census on Canada’s 20 largest cities, as well as real estate data from the Canadian Real Estate Association, comparing that with local listings in each city. A survey was also conducted with responses from over 890 renters nationwide.

In Halifax’s case, the results of the study are clear: For young, potential home buyers looking to make a 20% down payment on a starter home, it would take them over 10 years of saving, based on their average individual income. Median incomes for age groups were sourced from Statistics Canada and were compared with responses from renters about what percentage of their monthly income they save for a down payment.

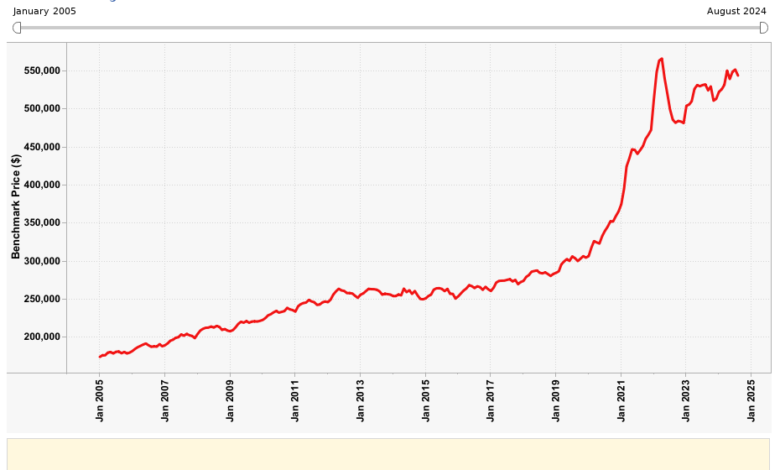

The study estimates that a starter home in Halifax costs around $274,400, meaning potential home buyers looking to put down a 20% down payment would spend around $54,880. The study considers a starter home to be a house that is worth half of the CREA’s housing price benchmark in a given city—which takes into account housing of all kinds, not just starter homes—and compares that amount to local listings to ensure accuracy. In June 2024, the benchmark for Halifax was $548,800.

Gen Z, identified as people between the ages of 15 and 24, are worst off in this respect. With an individual income of $21,214, they would need nearly 13 years to save a down payment of 20% in today’s market. Young millennials (ages 25-34) are better off, with an average income of $45,964 and an estimated six years to come up with a down payment. Older millennials (ages 35-44) may need four-and-a-half years to meet this 20% deposit, with an average individual income of $61,432.

Points2Home also analyzed how long it would take Gen X and Baby Boomers to come up with this down payment. For Gen X (ages 45-54), they could potentially reach this amount in just over four years according to their average individual income of $64,968. For baby boomers (ages 55-64), it may take them just over five years when going by their average individual income of $53,477. Older baby boomers (65 plus) are looking at a timeline similar to young millennials, with six years of savings based on their average income of $41,544.

Saving for a down payment

When respondents across the country were asked how much they had already saved for a down payment, 32% in all age groups said they had between $1 and $10,000, and 12% said they didn’t have anything saved.

Furthermore, 41% of respondents said they save under 10% of their monthly income to go towards a down payment. Another 31% said they save between 10 to 20% of their monthly income.

Down payments of 20% aren’t always needed to get a mortgage from a bank—the minimum is typically 5% of the home’s value—but 20% down is often considered less risky and more affordable over time, as monthly mortgage payments would decrease by potentially hundreds of dollars.

There are caveats to all of this, of course. There is currently a housing shortage throughout Nova Scotia, Halifax included, making it difficult to find the right home for an affordable price. It’s also worth noting that starter homes in Halifax have been on an upward trajectory in terms of price, due in part to scarcity.

Data from the Canadian Real Estate Association reveals that the average benchmark price of Halifax homes began to spike in 2020 after steadily climbing over the last decade. In January 2020, the benchmark was $306,500. Its peak was in April 2022, at $566,000. After several small dips, the benchmark started rising again in 2023, and it sits at $543,700 as of August 2024.

There are several aspects of this study to keep in mind. Firstly, it isn’t centered on just Halifax, but rather 20 of Canada’s largest cities. The number of respondents to the survey from Halifax is unknown, but is likely not the majority of the 890 renters who responded. Secondly, this data is based on individual income, not shared. Third, this study cannot account for how housing prices may change in the future—a fact the study acknowledges up front, stating that in a worst-case scenario, young renters may have to save even longer if housing prices continue to increase.

The average Gen-Z income can also be expected to increase over time, as many graduate from school or work their way up the ladder to find jobs with higher wages. For now, however, they may be stuck waiting upwards of a decade based on the 2021 census data.

For more on this study, check it out for yourself at Point2Homes’ website.