House Freedom Caucus members say Senate changes spell doom for Trump tax bill

Members of the conservative House Freedom Caucus are expressing serious concerns about the Senate’s version of President Donald Trump’s tax bill. They argue that the Senate bill would add $1.3 trillion to the federal deficit, a stark contrast to the House-passed bill which would only increase the deficit by $72 billion.

In a public statement released on Sunday, the House Freedom Caucus criticized the Senate bill, highlighting that it exceeds the agreed budget framework by $651 billion, even without factoring in interest costs. The Senate bill includes additional provisions such as a $25 billion rural hospital fund and a tax break for whalers, which have raised eyebrows among GOP rebels.

The Senate bill also seeks to permanently extend certain corporate tax cuts from President Trump’s 2017 Tax Cuts and Jobs Act, which the House only extended temporarily. Additionally, the bill would raise the debt limit by an additional $1 trillion compared to the House version.

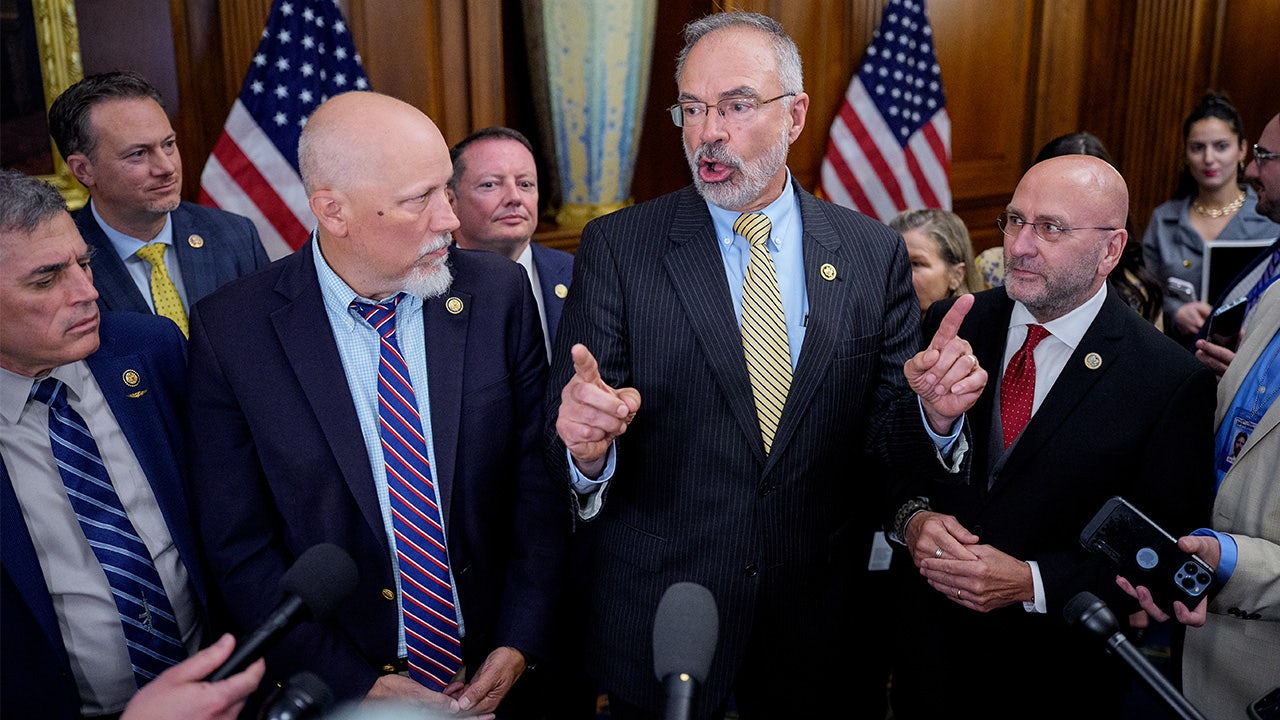

Despite the Senate’s efforts to address concerns with the bill, members of the House Freedom Caucus remain skeptical. Reps. Ralph Norman and Eric Burlison, both members of the caucus, warned that the bill could face challenges in the House if changes are not made. They suggested that the bill may not survive a House-wide procedural vote without significant modifications.

The fate of the bill in the House could hinge on an amendment proposed by Sen. Rick Scott, which would increase the financial burden for states that expanded Medicaid under the Affordable Care Act. Without this amendment, some House Freedom Caucus members believe the bill could be in jeopardy of failing in the lower chamber.

Republicans are utilizing the budget reconciliation process to advance Trump’s agenda on taxes, the border, energy, defense, and the debt limit through a single piece of legislation. This process allows Republicans to bypass Democratic opposition and pass the bill with a lower threshold for approval.

The Senate is working through a series of amendments to the bill, with a goal of having a final version on Trump’s desk by the Fourth of July. Despite the challenges and differences between the House and Senate versions, Republicans remain optimistic about the potential economic growth and revenue-neutral impact of the bill.

Overall, the House Freedom Caucus’s concerns highlight the ongoing debate and negotiations surrounding Trump’s tax bill. As lawmakers continue to work towards a final version, the outcome remains uncertain as both chambers seek to reconcile their differences and pass a bill that meets their respective priorities.