Financial regulator OSFI is increasing the minimum capital large banks must have on hand to cover losses

Canada’s financial regulator is increasing the amount of capital the country’s major banks need to cover potential losses, saying the financial system’s vulnerabilities are still high and, in some cases, have continued to mount.

The Office of the Superintendent of Financial Institutions said on Tuesday that the domestic stability buffer will increase by half a percentage point to 3.5 percent, effective November 1.

It follows a move by the regulator in December to increase the buffer by half a percentage point to three percent.

The federal regulator said current vulnerabilities facing the banking sector include high household and corporate debt, the rising cost of debt and increased global uncertainty about fiscal and monetary policy.

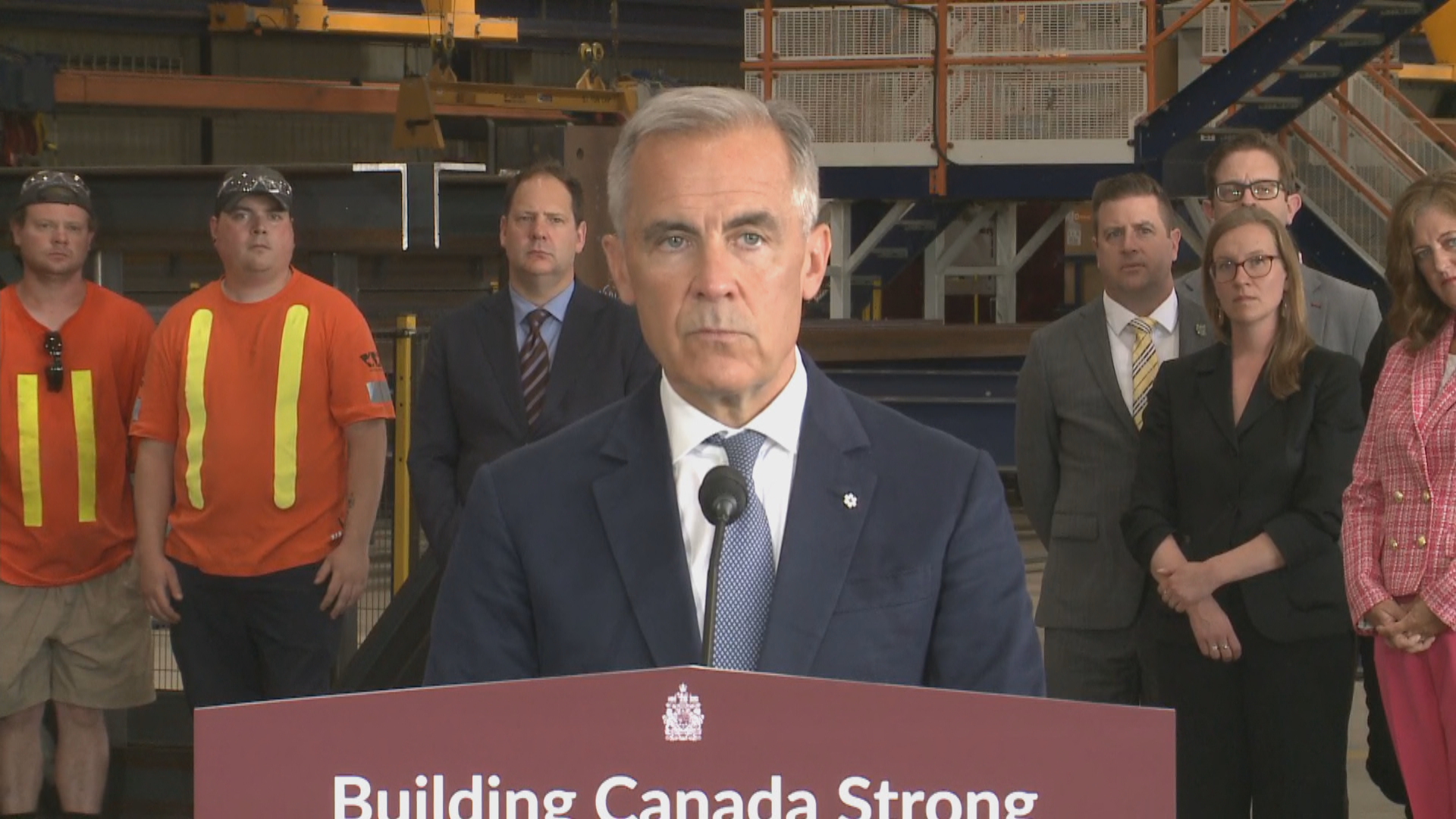

Peter Routledge, the superintendent of financial institutions, said households and businesses are still highly indebted, making them more vulnerable to economic shocks.

“At the same time, the Canadian financial sector has shown resilience over the winter and spring and Canadian banks have shown signs of strength,” Routledge said.

“We should use this opportunity to take further action to strengthen the resilience of our financial system. In other words, OSFI is buying more insurance for financial stability at an appropriate time.”

Routledge said it is ready to lower the buffer to support the banks if necessary.

“Should risks materialize, we will not hesitate to take action to support the resilience of the financial system by lowering the (buffer) level,” he said.

The domestic stability buffer applies to Canada’s six largest banks, the so-called domestic systemically important banks. It is reviewed and adopted in June and December each year, but may be amended at other times if necessary.

The increase in the buffer will increase the common equity tier 1 ratio for the big banks from 11.5 percent to 11.5 percent, a threshold that the big banks already exceed, according to Routledge. The ratio is an important measure of a bank’s financial strength, measuring its capital compared to its total risk-weighted assets.

The global banking sector has been under pressure this year with several bank failures in the United States.

US regulators closed First Republic Bank in May and sold the vast majority of its business to JPMorgan Chase in what was the country’s second largest bank failure.

The collapse followed the bankruptcy of Silicon Valley Bank and Signature Bank earlier this year.

;Resize=620)

;Resize=620)