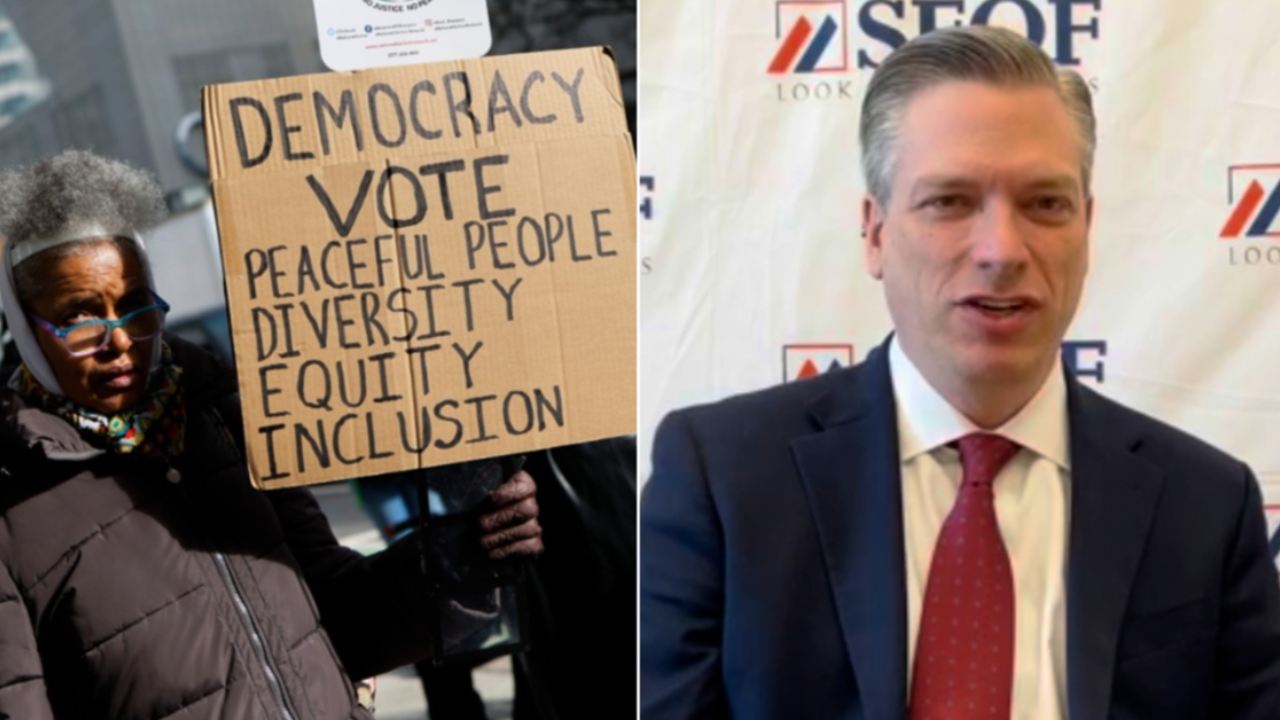

Red state treasurer reveals why state financial officers have ‘obligation’ to combat ESG, DEI

As Republican state financial officers across the country continue to push back against diversity, equity, and inclusion (DEI) and environmental, social, and governance (ESG) initiatives, Fox News Digital sat down with Utah’s state treasurer to discuss the importance of prioritizing meritocracy and fiduciary responsibility in investments.

Utah State Treasurer Marlo Oaks emphasized the significance of upholding fiduciary standards when managing money for others. Oaks argued that ESG investing introduces additional motives beyond financial gains, which can potentially violate the fiduciary duty to act in the best interest of beneficiaries. He highlighted the impact on essential workers such as firefighters, teachers, and police officers who rely on state pensions, stressing that investments should prioritize financial outcomes for these individuals.

Oaks has been a vocal opponent of ESG principles, authoring letters and speaking out against what he views as an agenda-driven approach to investing. He pointed to the detrimental effects of prioritizing DEI initiatives in corporate decision-making, suggesting that such measures could harm shareholder value and ultimately impact retirement savings for public servants.

At a recent conference, Oaks and other Republican state financial officers expressed their support for President Trump’s efforts to roll back DEI measures in government. They have been critical of policies that prioritize social agendas over financial returns, warning of the potential financial risks associated with such decisions.

In a joint letter to the U.S. Securities and Exchange Commission (SEC) and other stakeholders, Oaks and his colleagues raised concerns about the financial implications of prioritizing political agendas like DEI over maximizing returns. He emphasized that introducing DEI measures at the state financial officer level could lead to financial harm and negatively impact shareholder value.

Overall, Oaks underscored the importance of maintaining a focus on fiduciary responsibility and merit-based decision-making in investments. By prioritizing the financial best interests of beneficiaries, state treasurers can ensure that essential workers and public servants have the retirement savings they need. As the debate over ESG and DEI continues, Oaks and his colleagues remain committed to promoting sound financial practices that prioritize returns and protect shareholder value.