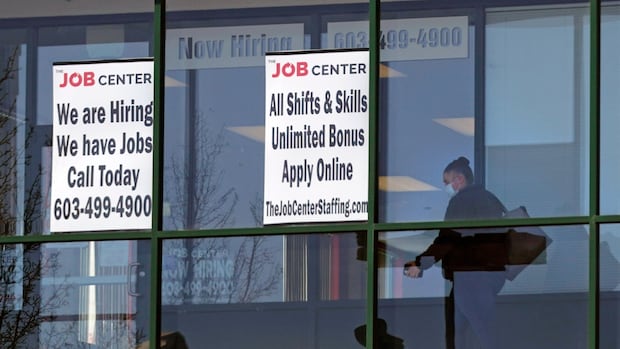

U.S. labour market weakens with little job growth and rising unemployment

The latest U.S. job growth data for August paints a concerning picture, showing a significant weakening in the labour market. This comes alongside an increase in the unemployment rate to nearly a four-year high of 4.3 per cent, indicating a softening of labour market conditions. As a result, there is a growing consensus that the Federal Reserve will need to cut interest rates this month to support the economy.

The report from the Labour Department highlighted that job growth has stalled, with the economy actually losing jobs in June for the first time in over four years. Economists are pointing to factors such as President Trump’s import tariffs and immigration policies as contributing to the softness in the labour market.

One of the key concerns is the imbalance between job vacancies and unemployed individuals, with more people looking for work than there are available positions. This mismatch is adding to the challenges faced by the labour market.

The impact of Trump’s tariffs is also being felt, with fears of higher inflation leading to uncertainty among businesses. A recent court ruling on the legality of these tariffs has only added to the confusion, keeping many businesses in a state of flux.

In Canada, the situation is mirroring the U.S. with the unemployment rate ticking up to 7.1 per cent in August and a loss of 66,000 jobs. This global trend of weakening job markets is a cause for concern.

Despite some growth in sectors like healthcare and social assistance, overall job creation is below expectations. The Federal government has seen a decline in payrolls, and industries like wholesale trade, manufacturing, and construction are also experiencing job losses.

The Federal Reserve has indicated that a rate cut may be necessary to address the risks facing the labour market. The potential cut is seen as a way to stabilize employment conditions and support economic growth.

As the labour market faces challenges, it is crucial for policymakers to take proactive measures to support job creation and stability. The upcoming decision by the Federal Reserve to cut interest rates could provide much-needed relief to the labour market and the economy as a whole.