Will short-term rental regulations increase Nova Scotia’s housing supply?

Short-term rentals in Nova Scotia, such as Airbnbs, will have to be registered with the province when new regulations come into effect at the end of September—a move the government hopes will create more long-term housing.

Announced in a press release from the Nova Scotian government last month, the rules introduced in the Short-term Rentals Registration Act will see new registration requirements, categories, rates and fines for non-compliance. Short-term rental operators will have to register their accommodations for a predetermined fee based on location and also need to prove that they’re compliant with municipal bylaws and have consent from property owners or condo boards.

These changes come in the wake of municipalities across the province, including HRM, introducing their own regulations to moderate short-term rentals. In September 2023, amendments approved by Halifax council to their municipal planning strategy and land-use bylaws came into effect—strict requirements to how and where short-term rentals could operate within the city.

In residential zones, entire home short-term rentals are only permitted in primary residences, not including second units. So you can rent your own house, but not that converted shed in the backyard. In commercial zones, they were permitted only where other tourist accommodations, such as hotels and motels, were also permitted. Short-term bedroom rentals, replacing bed and breakfast provisions, were allowed in both residential and commercial zones that support short-term rentals, but require the host to be on site while rooms are occupied, meaning no more “ghost hotels.”

Under the new provincial regulations, it will cost the host $50 to register for rentals within primary residences. This changes to $150 if hosts have five or more bedrooms for rent, matching the rate for traditional tourist accommodations.

Short-term rentals within commercial zones are broken down into tiers by municipality. If within tier one (Bedford, Beechville, Cole Harbour, Dartmouth, Halifax, Lakeside and Lower Sackville), the cost will be $2,000 for registration. Tier three (Clark’s Harbour, Digby, Lockeport, Mulgrave and Shelbourne) costs $240. Every other municipality in the province not covered by tier one or tier three is in tier two, costing $500 to register.

According to AirDNA data, there are currently 2,176 active listings for short-term rentals in HRM. As of July 2024 there were 7,193 short-term rentals registered with the province. The province’s goal is to make these numbers drop by turning hosts into landlords.

Potential for long-term housing

In an interview with CTV News, senior executive director of housing for the province Vicki Elliott-Lopez said she hopes the new regulations will open up more long-term housing, stating she would “love to see even 10%” convert from short-term to long-term.

According to a study ordered by the province and conducted by Turner Drake & Partners Ltd., Nova Scotia could fall short on housing by 41,200 units by 2027 if the current population growth remains status quo.

The question is: will the new regulations work to encourage hosts of short-term rentals to convert them into long-term housing units?

The growth of short-term rentals has primarily taken place over the last seven years. A study conducted by Statistics Canada shows that the total number of short-term rentals in the country sharply increased between 2017 and 2023, from 214,808 to 355,070. There was, however, a lull during the pandemic, when the tourism sector was essentially closed down. From 2019 to 2021, short-term rental units country-wide decreased from 303,521 to 245,109 before spiking again to the 2023 total.

Statistics Canada

Canada experienced a substantial increase in short-term rentals between 2017 and 2019, and then again from 2021 to 2023.

Also measured in the study are potential long-term dwellings—short-term housing that could potentially be converted into long-term housing. In Nova Scotia specifically, there were 10,875 short-term rentals counted by Statistics Canada in 2023. Out of these units, 2,987 were recognized to be potential long-term dwellings, making up 0.67% of the province’s total housing supply.

If all of these were to convert over to long-term rentals, that would cover a little over 7% of the expected shortage predicted in Turner Drake’s report. If it trended toward Elliott-Lopez’s hopes of a 10% conversion, it would cover 0.73% of the expected shortage.

No guarantees

However, there is no guarantee that hosts will see these regulations as anything but a barrier to entry. Short-term rentals within HRM’s commercial zones would be the hardest hit by these regulations, but according to AirDNA data, the median short-term rental unit in HRM generates an annual revenue of $23,800—presumably driven by larger operations such as ghost hotels within these commercial zones. If each short-term rental can make thousands of dollars in revenue in the province’s tourist hub, it’s likely hosts will just absorb the cost of registration, keeping their already profitable business model in place.

Hosts in other areas of the province—those listed in tiers two and three—have even less to worry about in terms of registration. For example, in Truro, if there is a short-term rental operating out of a commercial zone, they would have to pay $500 to register with the province. The current median annual revenue in Truro for a short-term rental is $17,600—a cost they can presumably pay without taking a huge financial hit.

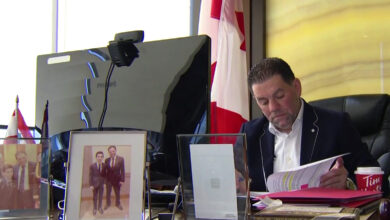

Provincial housing minister John Lohr may have put it best in this comment captured by CBC: “We know that this will cause some short-term rentals to return back to long-term rentals. Precisely how many is the subject of internal debate. We really don’t know.”

Lohr is right—it’s nigh-on impossible to tell whether or not this plan will work in the province’s favour. Even if it doesn’t make an impact in that sense, it could bear side effects that may improve the province’s housing situation. Registration fees may dissuade owners from transforming their properties into short-term rentals. The restrictions of where they can’t and can’t be, determined by municipal bylaws, can also prevent some units from being taken from the current housing supply.

So while regulation will probably affect the number of short-term rentals , it’s far from a guaranteed solution to increase the housing supply.